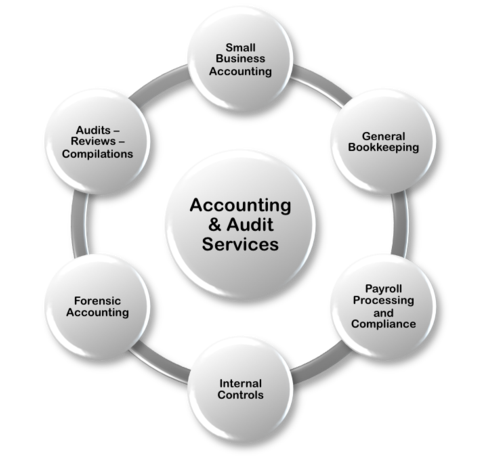

Accounting & Bookkeeping Services

As a small business owner, there will be times that you can certainly benefit from having a professional keep your books or provide other accounting and audit related services. Allow our practice to take care of things for you so that you can get back to the job of running your business and generating profits.

Each month or quarter we can do the following things and more for you:

- Reconcile your bank and business credit card/line of credit accounts

- Generate financial statements (Income Statement, Balance Sheet, etc.)

- Clean up your general ledger and review for discrepancies such as double billings or unrecorded payments

- Ensure that all capital assets are recorded and depreciating appropriately

These tasks for the solid foundation of your small business accounting system. You can customize the package of services you receive by adding payroll, tax planning, tax preparation, or any of our other services.